Overview

Smava is the fully digital loan comparison platform in Germany. Smava help user from finding the best price offer from several banks, pre-qualified, sending the application, until getting the money. smava has data and research driven culture to understand and predict market and customer behaviors.

My role

I am the UX designer in cross-functional team. I am mainly responsible on the ‚offer‘ journey route with UX researcher, project manager and 4 developers. We ensure that the user will get the ‚right‘ offer that match their needs and convert to the checkout. We are also work with the marketing team to deliver promotional campaign and affiliate program.

Understanding the problem

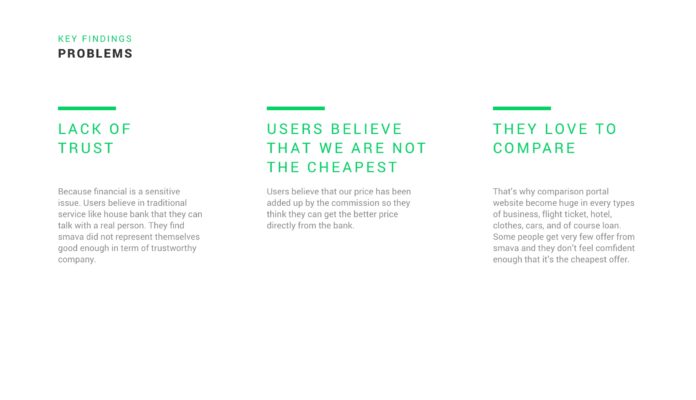

Financial is very sensitive topic. People are very careful in making a choice on their financial situation combine with the fact that there are so many choices in the market which will make it even harder for the user. Our challenge is to find the design solution that make user feel safe and confident that they are making the right choice with smava.

Me and UX research team conducted the research plan to gather the insight with both qualitative and quantitative method. The goal is to;

- Define the personas

- Understanding the goal and need of each persona

- Understanding the user’s behavior and the reason behind the decision making

Gathering insights

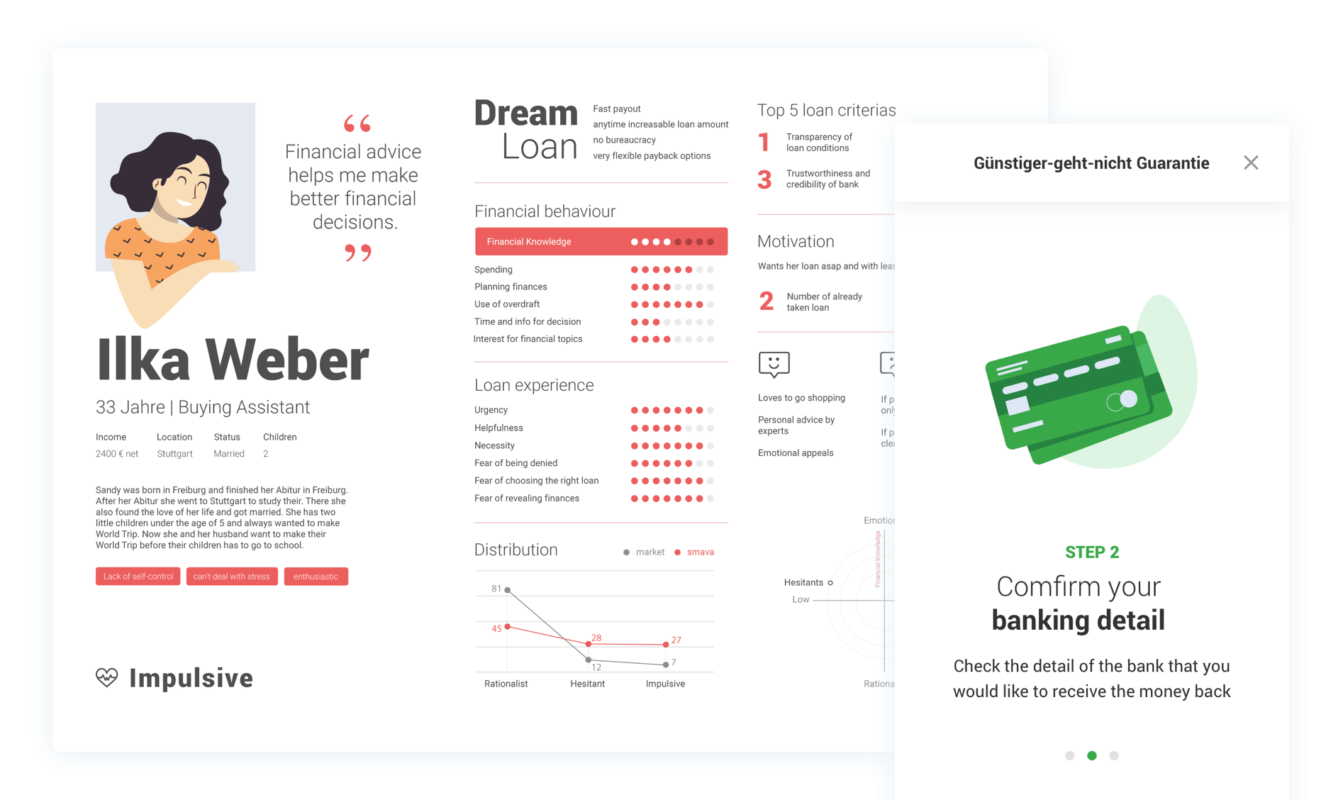

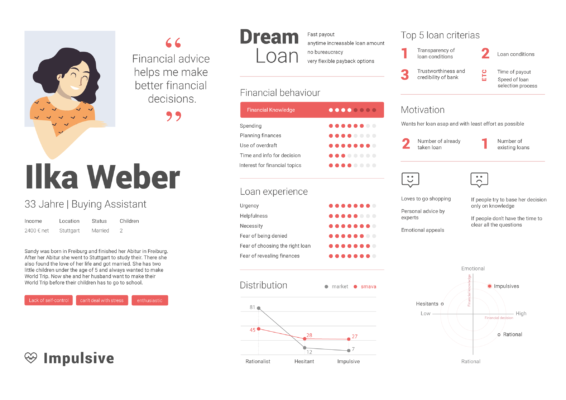

Personas

Our personas based both qualitative interview and quantitative data from survey. We differentiate our persona into 3 groups which are;

- Rational

- Hesitant

- Impulsive

Our data shows that smava has more impulsive / persistent customer than the market’s average.

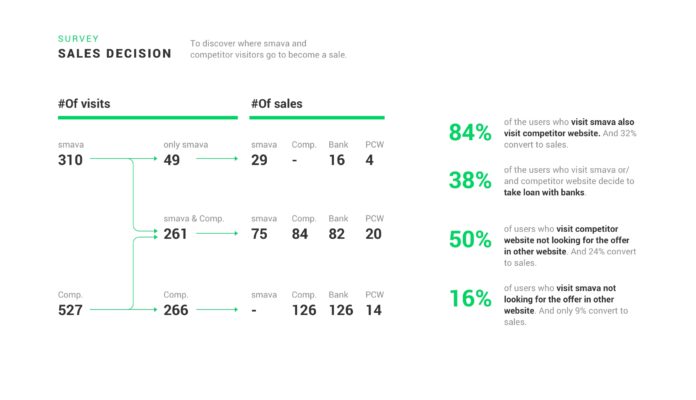

Sales survey

We conducted the survey to discover sales decision on our platform, online competitors and banks. Analytics result show that

- 84% of the smava’s visitors go and check other competitors after they come to us.

- Majority of the user who visited our website and competitors website, decided to take loan from the banks.

Data analytics

To understand how many users leave smava in each stage and how much time do they take in the offer page.

- Majority of the users leave smava in the registration stage

- Majority of the users who convert in to sales are returning customers.

User interview

- We found out that 5 from 6 people will not directly make the decision in the first time that they see the offer based on the offer information we provided.

- User believe that our price is not cheap because it has been added up by the commission.

- We found out that users have different needs on the loan. Price is the most but not only condition they use to consider.

Key findings

goal

What kind of value would this bring if we solve the problem?

-

We expect to decrease the decision making time which could bring more conversion.

-

We expect to decrease the drop-off on the offer.

-

User make easier decision to proceed to the loan.

-

Create more trust and transparency as a loan comparison portal.

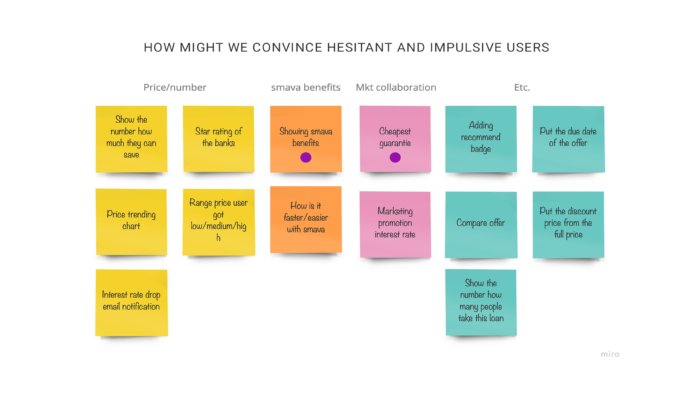

Ideation

We had a workshop together with stakeholders from product and marketing team to brainstrom the initial ideas on how to convince hesitant and impulsive users to make the easier decision in offer stage.

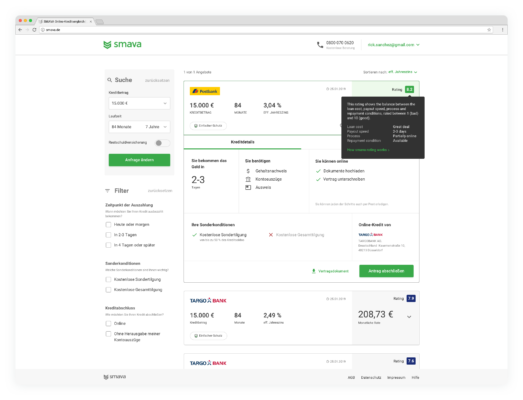

Solution 1: smava score

We learned that each user had different criteria in choosing the loan and it’s not all about the price. Time to receive money, easy process, less document, trust in banking brand are also factors that users use to consider. And once we gave multiple offers with different conditions to the user, it is very difficult for them to compare and make the decision.

We came up with the idea to implement smava scorebase on several criterias. We did the research on many of comparison platform even they’re not fintect and found it interesting that user will always believe on rating number.

We tested the concept with the users as below;

Defined MVP

Base on concept testing, we came up with the MVP version which only based on simple criteria which are;

- Interest rate

- Payout speed

- Online process

- Repayment condition

After launched

We find out that user clicks more on the offer that have higher rating than 8 and tend to convert more on the offer with highest rating.

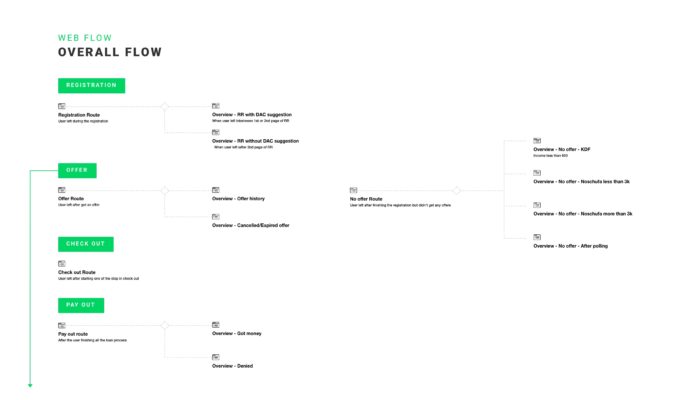

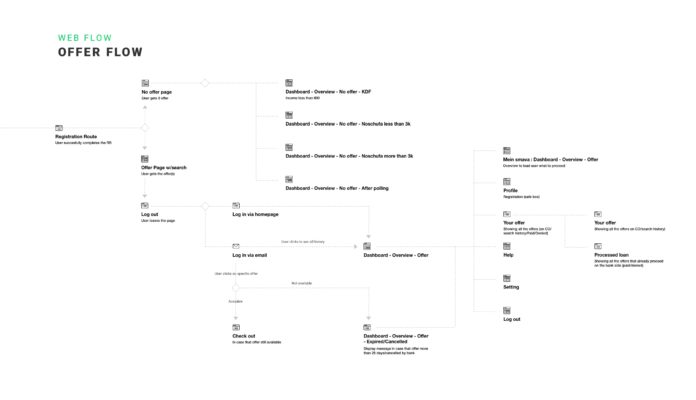

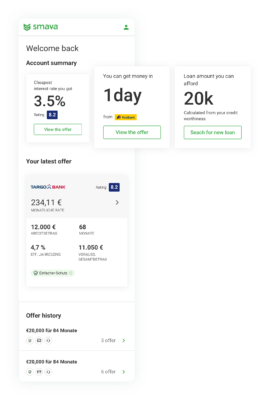

Solution 2: Dashboard for returning customer

The data shows that the majority of the users do not make the decision in the first place. We believe that dashboard will be the good guidance for the user.

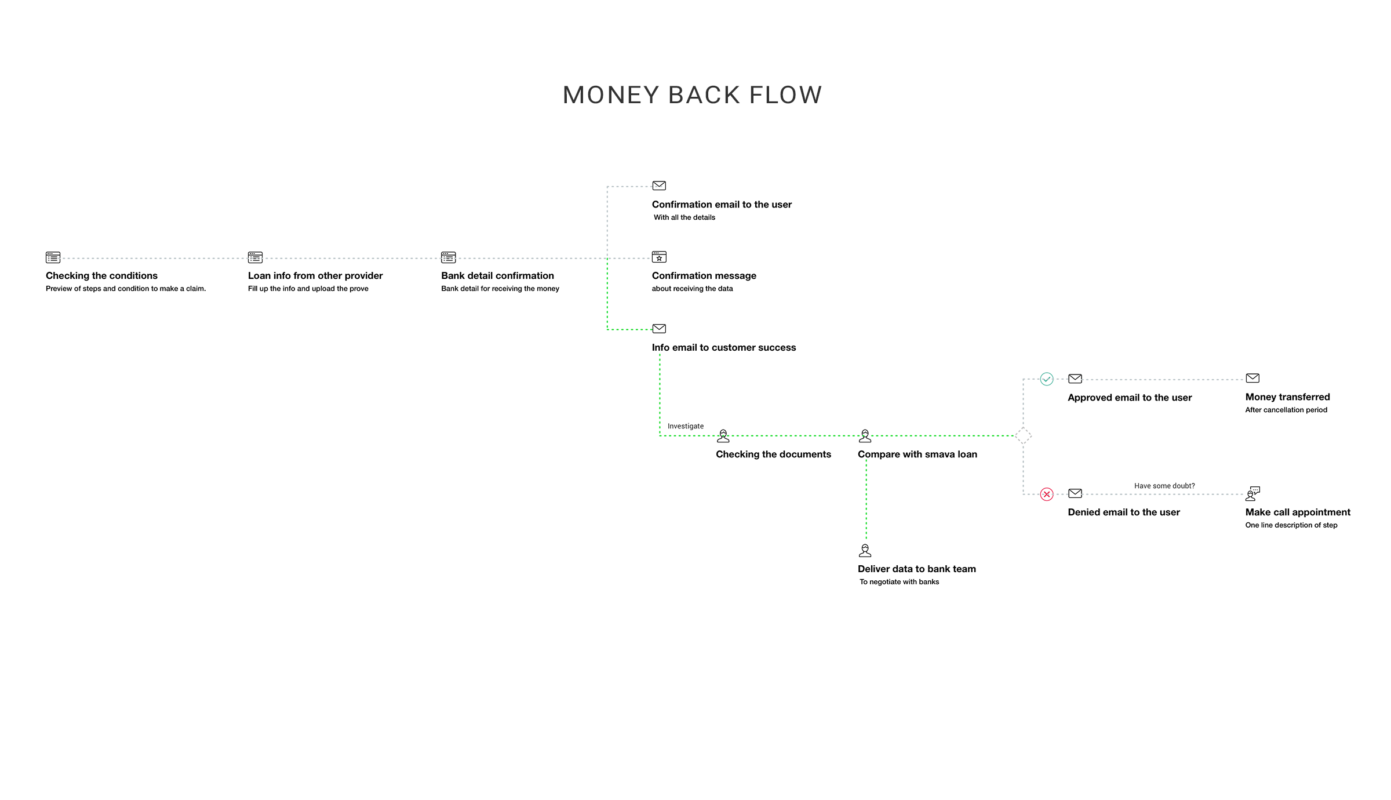

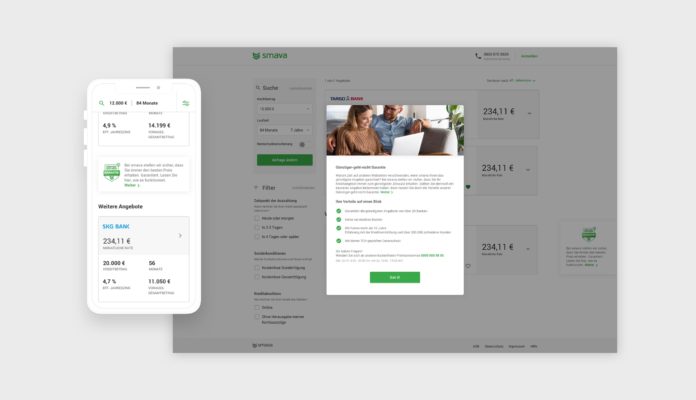

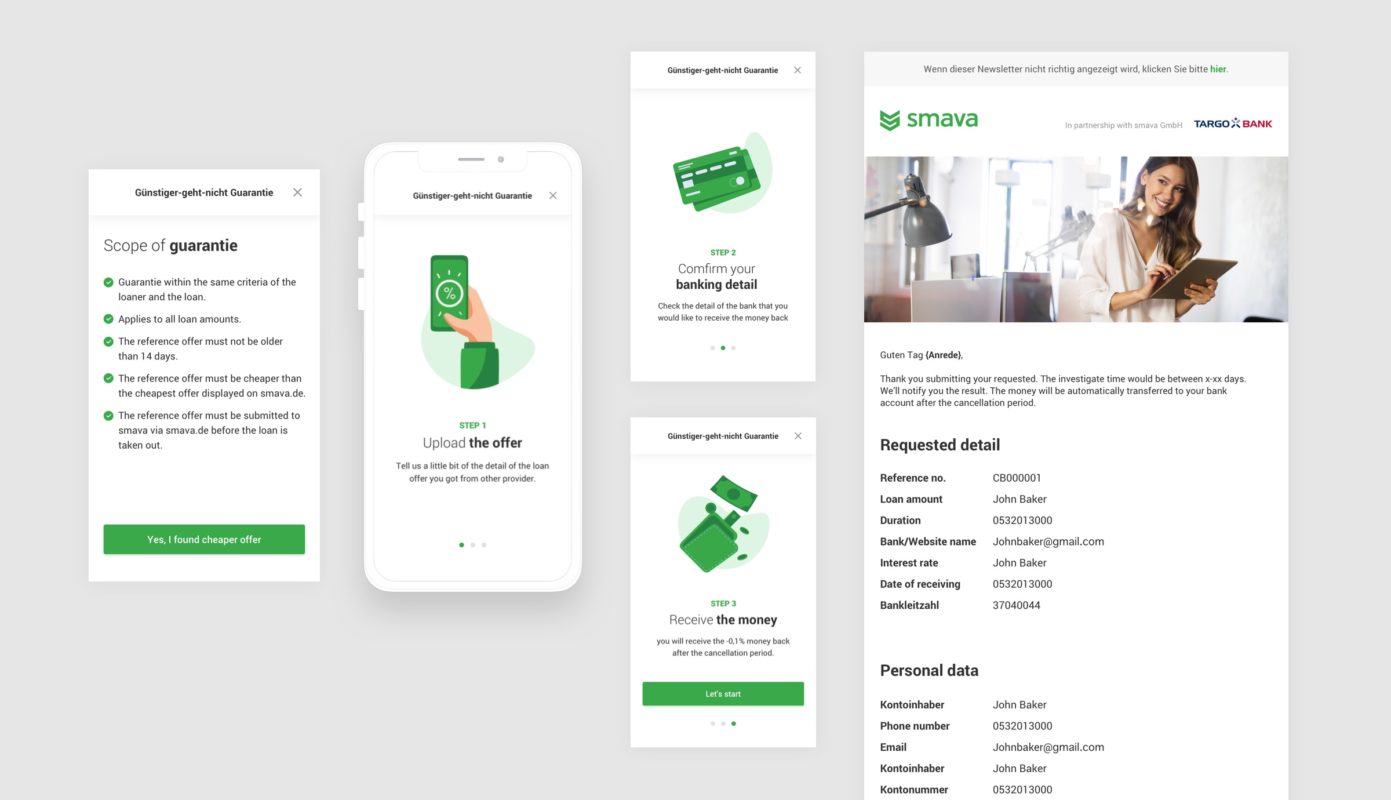

Cheapest guarantee

We found out that 84% of the smava’s visitors go and check other competitors after they come to us. We worked with the marketing team to launch this campaign to convince users to be confident that they can get the best offer from smava without the need to check other platform or banks.

Defined MVP

We implemented the banner in the offer page together with benefit and detail of the campaign. Marketing team also launched TV commercial on this concept. We keep the money back online process for later iteration.

After launched

Together with TV campaign, the overall conversion rate was significantly increased. For the offer, we also found less drop-off rate from the first time user.