Overview

Corona effects many business around the world as well as loan business in Germany. When needs and usage of the loan has been changed, we need to quickly adapt our product to support the users. This project happened is to explore the problem and find out how should we react to the situation.

My role

I am UX/UI designer responsible on the ‚offer‘ journey route with UX researcher, project manager and 4 developers. We ensure that the user will get the ‚right‘ offer that match with their needs in this special situation.

Understanding th problem

To explore the best way to suggest the offer choice that have easier/smoother process to the user regarding the corona situation.

Gathering insight

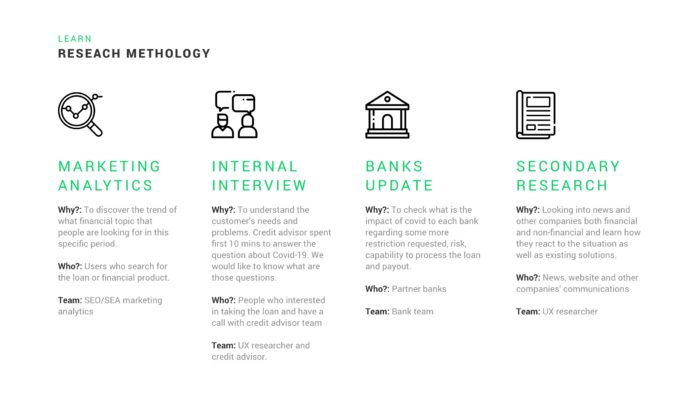

-

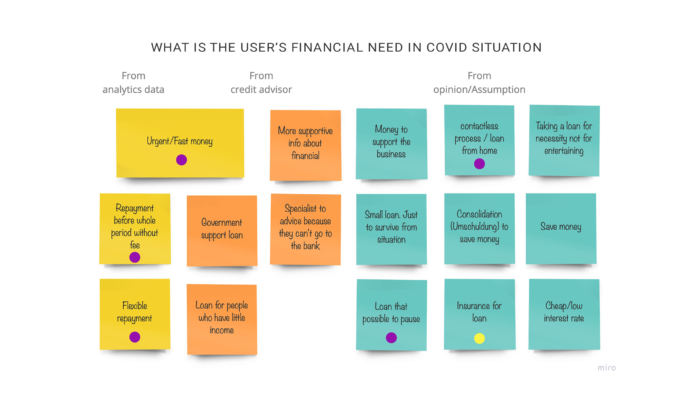

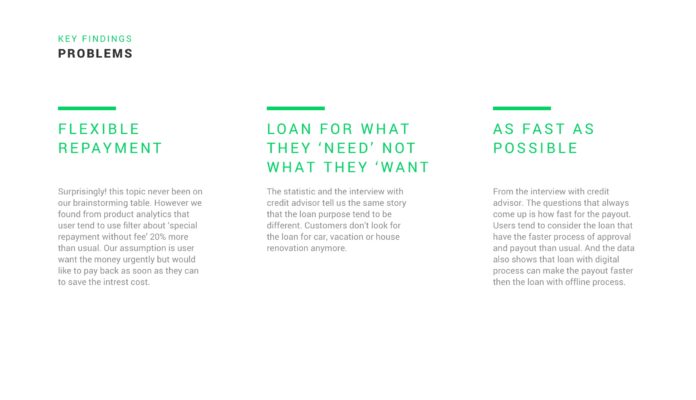

User doesn’t want to have the contact with many people

-

More strict policy from the banks. It tend to be more difficult for the user to get less offer/loan.

-

User might need urgent/fast money. The purpose to take the loan has been changed.

Ideation

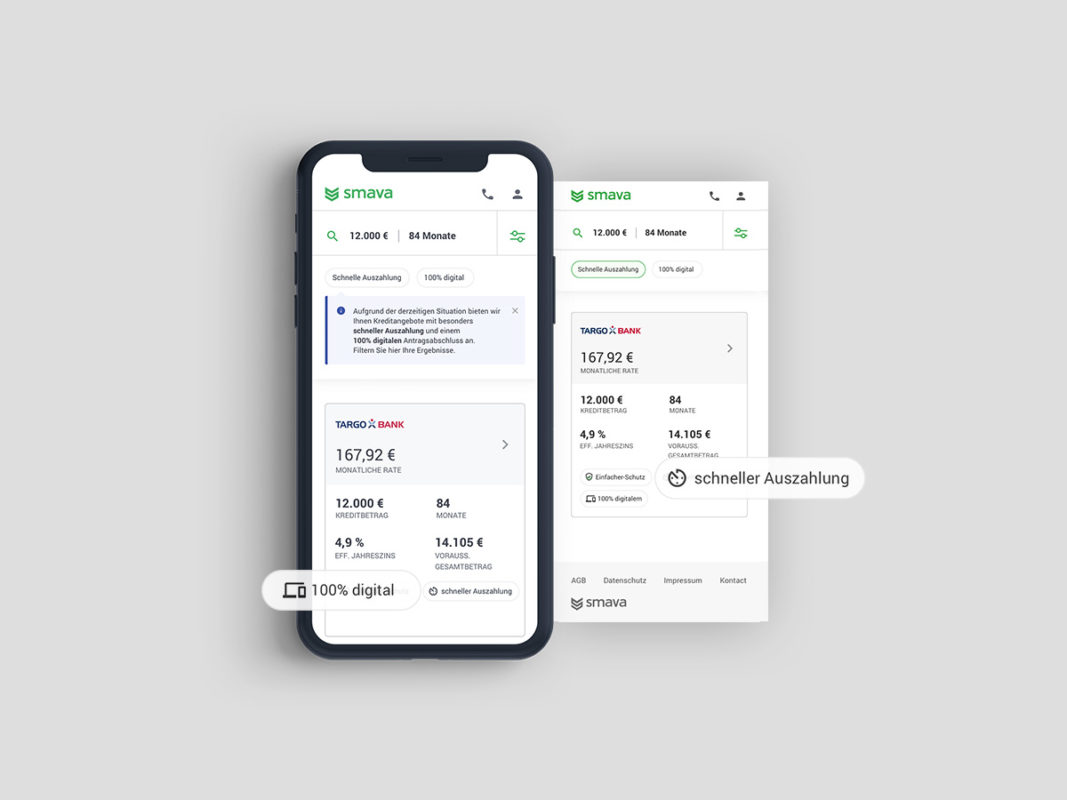

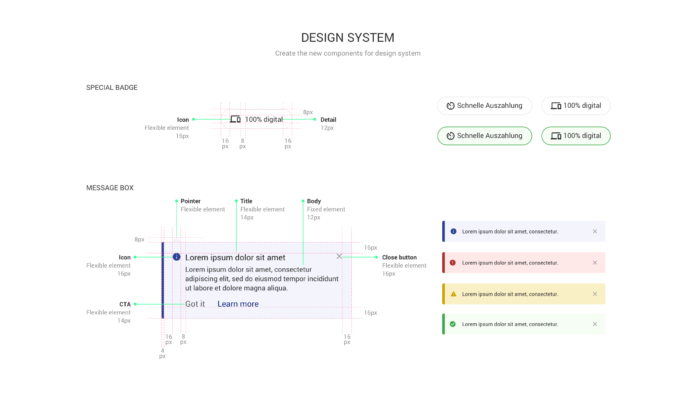

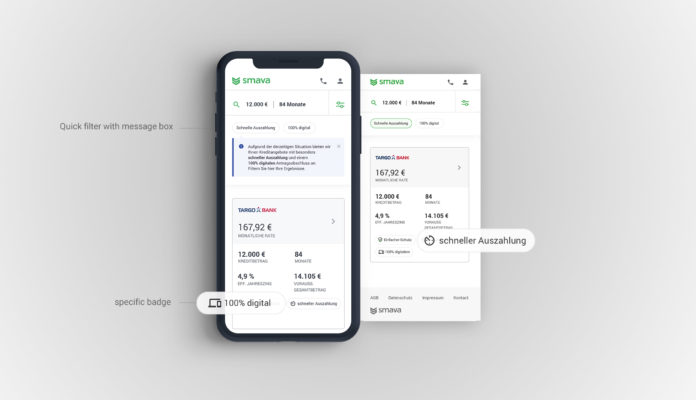

- Integrate the quick filter and introduction message to for 100% digital badge and fast payout (Under 3 days) to the users.

- Add special recommendation badge on the offer that have both 100% digital and fastest payout.

Measuring the success

- Measure the conversion from offer page to checkout

- Measure the conversion on the specific banks that have 100% digital process and fast loan.

- Measure the use of different filters.

What kind of value would this bring if we solve the problem?

-

Increasing of the conversion from the offer page to checkout on specific banks that have 100% digital process and fast loan.

-

Increasing of the success number of people who proceed with the digital loan. In all stages which is document upload, DAC, Video identification, QES.